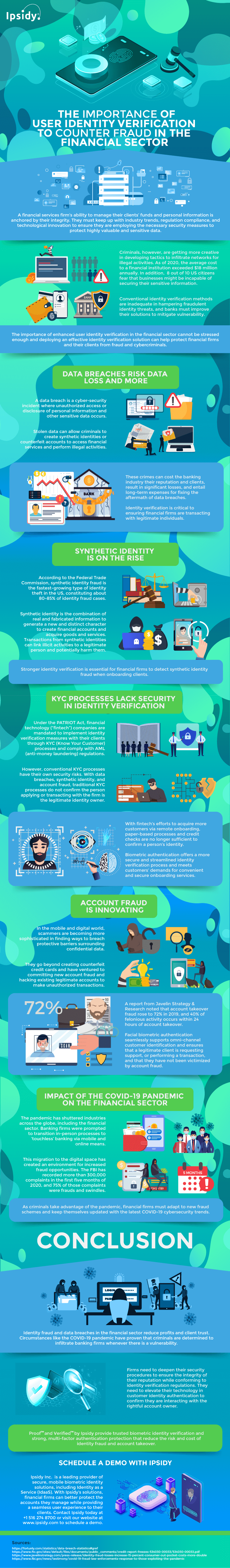

Government agencies continue to reinforce the need for the regulated sector to improve their security measures to protect sensitive information and other valuable assets. One of the most stringent regulations enforced is in the financial industry, which is often prone to fraud and other financially-driven criminal attacks.

In New York, the Department of Financial Services (DFS) updated their requirements for financial services companies, reiterating the adoption of better user identity verification like multifactor authentication (MFA).

MFA uses a combination of two or more authentication factors, such as something you know (passwords), something you have (security codes sent to mobile devices), and something you are (biometrics).

Biometric identification is considered an ideal authentication factor. It employs controls and procedures like liveness detection to ensure that the person interacting with the firm is present in real-time. This modern identity proofing method can distinguish between real people and synthetic identities, thwarting attempts to cheat the system.

Some utilize two-factor authentication (2FA), a subset of MFA limited to only two authentication credentials. However, when companies implement a third factor, it adds an extra barrier to prevent fraudulent attempts.

Most users feel inconvenienced when going through numerous processes for identity verification, but with biometric multifactor authentication solutions, the procedure is performed in a few seconds, thereby delivering a hassle-free user experience.

Reputable companies that offer identity as a service (IDaaS) can help financial enterprises with their verification technology needs. Leveraging innovative tools for security checks during customer onboarding and before authorizing transactions allows banks to block fraudulent individuals more effectively.

Deterring fraud in the financial sector ensures regulatory compliance and helps financial institutions increase their ability to manage and protect clients’ funds and personal data. With improved security measures, banking firms can promote better consumer trust, expand their customer base, and generate more revenue.

Ipsidy expounds on the importance of implementing a trusted user identity verification solution with the information listed in the infographic below.