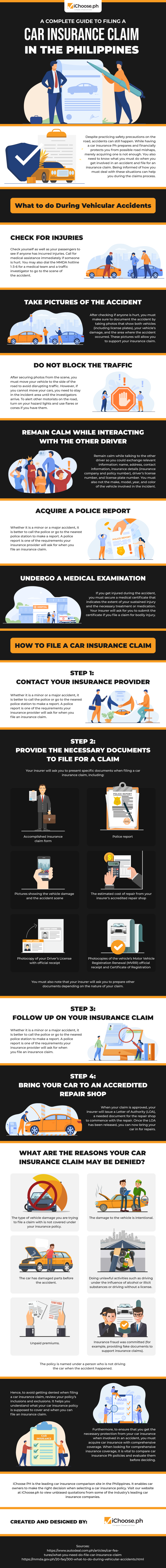

Accidents are still possible on the road despite practicing safety measures and precautions. Opting for comprehensive car insurance in the Philippines can financially help when you encounter problems and mishaps on the road. However, car owners must also know what to do when they get involved in an accident on the road and file for an insurance claim, and being informed can help during the insurance claim process.

What To Do During Vehicular Accidents

In a road accident, check yourself and other passengers to see if there are any injuries. It is essential to immediately call for medical assistance if someone is hurt in an accident. After you check if anyone got hurt, it is also necessary to document the accident by taking photos showing the accident’s damage. Reporting the accident can be a support to your insurance claim.

It is also essential to make sure that you move your vehicle to the side of the road so there is no disruption in the traffic. If you cannot transfer your car, you need to stay in the area and alert other motorists on the road through hazard lights or flares.

How to File a Car Insurance Claim

1. Contact your insurance provider

After documenting the accident and settling with the other party involved in the accident, you may proceed to file an insurance claim that can help you walk through the things you need to do.

2. Provide the necessary documents to file for a claim

When filing for an insurance claim, your insurer will ask you to present specific documents. It includes a police report, documentation of the vehicle damage and scene of the accident, estimated cost of repair, photocopy of driver’s license, motor vehicle registration renewal (MVRR), and registration certificate.

3. Follow up on your insurance claim

Filing for insurance can take as long as a month because there will be a thorough investigation and assessment to validate the submitted documents.

4. Bring your car to an accredited repair shop

Once your insurance claim is approved, a Letter of Authority (LOA) will be issued, which is a document that is needed for the repair shop to proceed with repairing the car.

For more information about filing a car insurance claim in the Philippines, here is an infographic provided by iChoose.ph.